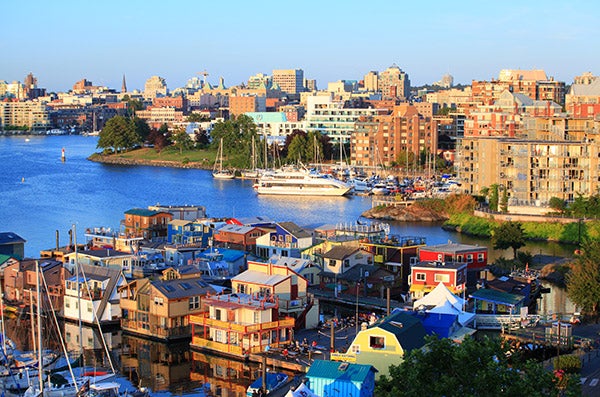

Land ownership is rewarding and can be a great investment. Knowing exactly what you are buying is very important and research is required.

There are many forms of interest in land. We have created a list of the most common examples found in British Columbia with pros and cons for each.

If you have any questions please feel free for to contact us to help clear things up!

“Freehold” is the type of land interest we mean when we refer to outright “ownership’ of property.

The owner of the freehold interest has full use and control of the land and all the buildings on it. This ownership is subject to the rights of the Crown, if any, as well as local land-use bylaws and any other restrictions that existed at the time of purchase.

Freehold interest is also known as a fee simple.

There are many forms of interest in land. We have created a list of the most common examples found in British Columbia with pros and cons for each.

If you have any questions please feel free for to contact us to help clear things up!

Freehold (Fee Simple)

“Freehold” is the type of land interest we mean when we refer to outright “ownership’ of property.

The owner of the freehold interest has full use and control of the land and all the buildings on it. This ownership is subject to the rights of the Crown, if any, as well as local land-use bylaws and any other restrictions that existed at the time of purchase.

Freehold interest is also known as a fee simple.

Pros of freehold ownership:

Unless you are the ruler of your own country, this is the form of ownership least subject to the rights of others.

The Torrens Land Title system we use in Canada is very secure and many protections are in place for property owners.

Cons of freehold ownership:

Very few. If you hold a mortgage, you are obviously expected to pay it, and some people prefer the freedom of renting.

Common Examples:

Most single-family homes in residential neighbourhoods are freehold, though some bare-land strata units can look very similar.

Leasehold

Although it’s not uncommon to rent or lease a property from a homeowner on a monthly or annual basis, for our purposes let’s take a look instead at a longer term lease situation.

Leasehold units are commonly mistaken for condos, but the difference is significant.

Generally, a parcel of land or building is leased by a company (often up to 99 years) which then sells sub-leases to individuals for use of specific areas within the building or land.

This gives the right of use for an extended period but the head lease company generally controls upkeep, sets monthly fees for maintenance and common costs, and so on.

When the lease is up, the right of use and occupancy reverts back to the original landowner, along with any improvements. It’s very important to review the head lease carefully when considering this type of interest in land.

Pros of leasehold interest:

- Leasing is more secure than renting.

- There is more leeway for owner improvements and renovation within the unit.

- Often less expensive than freehold ownership.

- This form of interest can be assigned (sold) to another party, so depending on the time remaining on the lease there is potential to profit on your investment.

Cons of leasehold interest:

- Difficult to obtain financing.

- Risk of large assessments and no say in building upkeep or fees (see strata).

- What happens when the lease term is up?

Common Examples:

- Townhouses and mobile homes on First Nations land.

- Large “apartment” buildings such as Orchard House in James Bay.

Residential Lease / Tenancy

Rental agreements are governed by the Residential Tenancy and there are protections in place for both owners and renters.

Pros:

Maximum commitment is generally one year, allowing for flexibility if you anticipate a move or travel.

Cons:

- Money paid for rent is non-recoverable.

- There is no investment value and, subject to the act, landlords can reclaim the space for their own needs which means it is difficult to make long-term plans for the property.

Strata Title Ownership (and Bare-Land Strata)

Ownership of a strata lot is similar to ownership of any freehold or fee simple lot. A strata corporation owns the freehold parcel which has been divided into strata lots. Individuals purchase strata lots within the parcel. Consider this a sub-set of fee-simple ownership.

The strata title ownership gives exclusive use and ownership of a specific residential unit or lot (the strata lot), typically a condominium or townhouse.

These units are all contained in a larger property known as the strata property. There is shared use and ownership of common property within the strata property.

A document called the Strata Plan is registered with Land Title Authority and outlines various types of areas, such as common property areas for use by all owners, areas of common property for the sole use of the owner (eg. parking or storage), and areas which are part of the strata lot. The Strata Property Act governs how strata are run.

Varieties of strata title

Strata titles come in various forms.

A condo building is generally set up as a common property parcel of land, with a building containing common areas on this land, and individual strata units available for purchase within the building.

Owners are generally responsible for upkeep and repair of the interior of their unit, but common area repair is the responsibility of a strata corporation which is made up of all the strata owners.

Fees are collected and rules and bylaws are enforced by an elected strata council. Decisions are generally made by vote of the owners.

A bare-land strata does not parcel out units within a building – it is only the land which is parceled.

In bare-land stratas, a fee simple property is divided into strata lots, usually sharing a common asset such as a road or septic field, but the structures built onto the land are owned by and maintained by each individual owner rather than by the strata corporation.

Pros of strata title ownership:

- Recognized by banks and lenders and generally easier to finance than anything but freehold ownership.

- Group decision making for common assets.

- Generally good investments.

- Cheaper than freehold.

Cons of strata title ownership:

The owners also share financial responsibility for its maintenance. If a strata project has unknown or unannounced issues, strata fees can rise dramatically.

Strata councils are not always functional, personalities may clash and poor decisions may be made. It’s important to know what you are buying into and read carefully the documentation that comes with this ownership.

Common Examples:

Some rural developments which appear to be fee simple may in fact be “bare-land” stratas. This can be determined by looking at the title documentation.

Most commonly seen as condos and townhouses.

Co-Op

Co-operatives are a form of ownership where each owner owns a share in a co-operative company or venture. The business venture in turn owns the property which contains the housing units. Each shareholder is assigned one particular unit in which to reside. As well, co-operative shareholders may instead be designated a lot on which to build.

Pros of co-ops:

Allows for a group of people to purchase a building or large swath of land which may not be obtainable individually.

Cons of co-ops:

- Does not have the same protections as strata ownership (the typical form of group ownership).

- Very difficult to finance

- Generally found in older buildings in Victoria that pre-date condominiums.

Common Examples:

There are numerous examples in Oak Bay, generally older buildings with 5 to 10 units.

Fractional Ownership

Fractional ownership is a form of property ownership where several people can divide the cost of a piece of real estate among them, typically to use as a vacation home.

Owners share in the cost and use of the property, and fractional ownership makes it possible to own one quarter, one eighth, or even one tenth of a property.

This real estate tool is similar to timeshares. However, with a timeshare you are buying time at the property and receive little else.

Fractional ownership is generally seen in strata buildings, but could also exist in freehold. The interest is shown on title and registered at land title office.

Pros of fractional ownership:

A more affordable way to own a vacation property.

Common Examples:

Often sold as 1/4 shares, agreements are generally in place which outline how often and for how long each owner has access and use of the unit

Victoria has a few fractional ownership units in boutique hotels (unused time can be placed in a rental pool) on Bear Mountain, and in some downtown residential buildings.

Land ownership is rewarding and can be a great investment. Knowing exactly what you are buying is very important and research is required.

There are pros and cons to each form of interest in land, and it’s a good idea to consult with your investment advisor, REALTOR, and lawyer before choosing any particular style.

Common Examples:

Often sold as 1/4 shares, agreements are generally in place which outline how often and for how long each owner has access and use of the unit

Victoria has a few fractional ownership units in boutique hotels (unused time can be placed in a rental pool) on Bear Mountain, and in some downtown residential buildings.

Conclusion

Land ownership is rewarding and can be a great investment. Knowing exactly what you are buying is very important and research is required.

There are pros and cons to each form of interest in land, and it’s a good idea to consult with your investment advisor, REALTOR, and lawyer before choosing any particular style.